A slow start, but a strong finish

New jobs, a boost in construction and growth in every sector will be the engines behind Orange County’s economic growth in 2015 and into 2016, according to the annual Economic Forecast Update issued by Chapman University’s

A. Gary Anderson Center for Economic Research

.

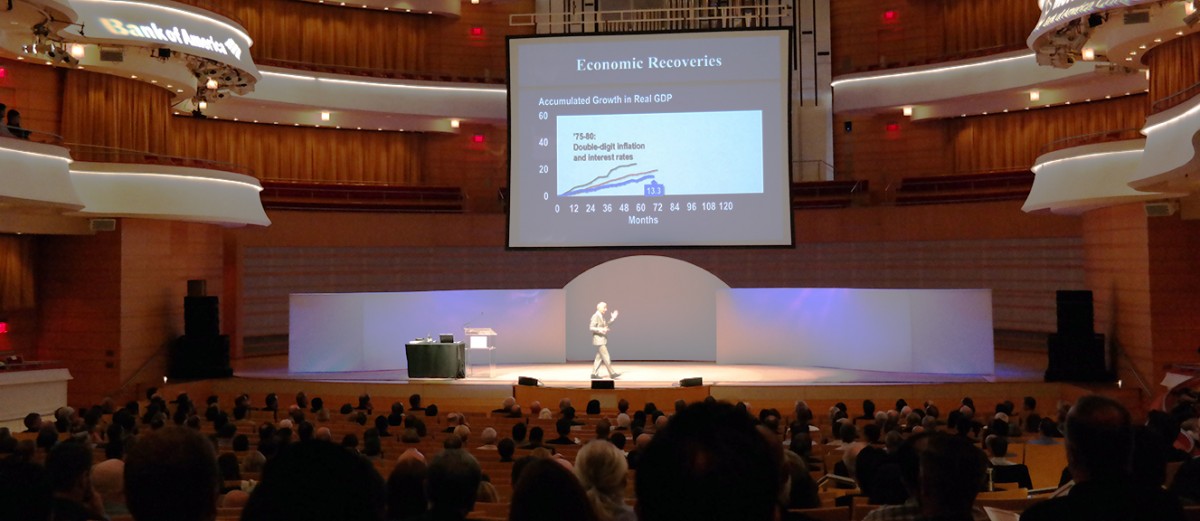

And while the long recovery grows ever longer, it isn’t finished yet, said President Jim Doti, Ph.D., the Donald Bren Distinguished Chair of Business and Economics and founder of the Chapman forecast.

“We are now beyond the average length of a recovery, about 60 months past that. So we’re now into middle age, if you will, in this recovery,” Doti said.

The center presented its updated economic forecast to some 900 Orange County business and community leaders assembled at The Segerstrom Center for the Arts, Costa Mesa, Calif., on Wednesday, June 24.

Speaking specifically to the California economy, Esmael Adibi, Ph.D., director of the center, said the state can generally look forward to a healthy outlook. But he added that there is a major caveat. Housing affordability is declining and can slow new household formations, he said.

“This is a serious problem,” he said.

Following are highlights of the forecasts. The complete results are reported in the

Economic and Business Review

.

2015-16 U.S. Forecast

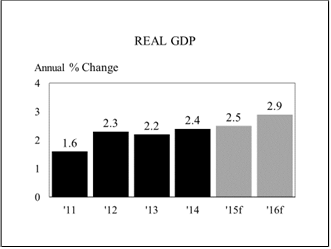

- The current expansion is now 69 months long, almost a year longer than the average recovery period. But it also is one of the weakest on record, with cumulative growth of only 3 percent during the entire expansion period. This compares to growth of 40 percent and more during the 1961-’69, 1982-’90 and 1991-2001 expansions.

- The rate of real GDP growth in the first quarter dropped. This is pretty much a repeat of the sharp decline in real GDP growth in the first quarter of last year. The strong dollar hurt exports and led to a surge in imports. Port closures in the West negatively affected trade. The drop in oil prices caused a sharp drop in exploration. And another bad winter in the Northeast put a crimp in consumer spending.

- Economists believe that the seasonal adjustment methodology isn’t correctly capturing seasonal change during the first quarter of the The “residual seasonality” once accounted for should add about 1.5 percent to real GDP growth in the first quarter of 2015.

The largest component of real GDP is consumer rising household net worth caused by higher housing prices and continued strength in the stock market will help fuel continued growth in consumption. Historic lows in household debt will also support higher levels of spending. These trends point to consumer spending increasing at rates near to three percent in 2015 and 2016.

The largest component of real GDP is consumer rising household net worth caused by higher housing prices and continued strength in the stock market will help fuel continued growth in consumption. Historic lows in household debt will also support higher levels of spending. These trends point to consumer spending increasing at rates near to three percent in 2015 and 2016.

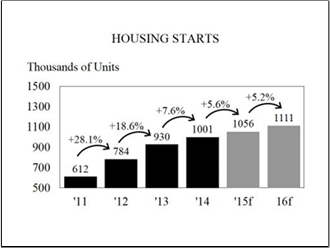

- Low interest rates will keep construction on a positive. Not only are rental vacancy rates near historic lows but the supply of unsold housing units is as well. On the negative side, housing affordability has dropped back a bit, mainly as a result of rising home prices. So while the rate of housing starts is projected to slow, our forecast calls for steady increase in excess of one million units in both 2015 and 2016.

- Continued growth in residential as well as commercial construction will buttress investment spending. In addition, a capacity utilization rate close to 80 percent currently indicates the need for more investment in plant and equipment. So despite the drop in oil exploration and extraction, investment will increase at a healthy pace of over 5.0 percent in 2015 and 2016.

Overall, forward momentum is building on the spending. We see growth in real GDP increasing 2.5 percent in 2015 and approaching three percent in 2016.

Overall, forward momentum is building on the spending. We see growth in real GDP increasing 2.5 percent in 2015 and approaching three percent in 2016.

- This will exert some but not much pressure on prices. It will be enough, though, to convince the Fed to increase interest rates in September or later this year. The Fed will continue to carefully but steadily increase the federal funds rate by 150 points, pushing up other interest rates, through the end of 2016.

2015-16 California and Orange County Forecast

- The March benchmark data released by the Employment Development Department (EDD) revised upward job growth estimates for California and Orange County in 2014. California’s payroll job growth was revised upward from the preliminary growth rate of 2 percent to 3.0 percent. Orange County’s job growth was revised to 2.5 percent versus an initial estimate of 2.0 percent.

- California’s employment growth in 2014 was broad-based. Every sector of the economy experienced job growth. The construction sector at 6.0 percent job growth was the fastest growing sector followed by the leisure & hospitality sector at 4.8 percent, professional & business services sector at 3.9 percent and education & health services sector at 3.8 percent.

- With strong employment growth, the unemployment rates, both in Orange County and California, showed steady decline after peaking in the first quarter of 2010. On average, unemployment rates declined by about 5.5 percent from peak rates of 10.0 percent and 12.6 percent in Orange County and California, respectively.

- On the residential side, a tight inventory of resale homes and higher home prices induced a higher level of permit activity in 2013 and 2014. As for 2015 and 2016, the number of permits will remain stong. On the nonresidential side, the vacancy rates for all types of properties are declining and that, in turn, is supporting stable to higher lease rates and prices. With prices firming up, new commercial real estate projects are becoming more economically viable.

- Overall, our measure of construction spending, which is derived by the lagged real values of permit valuation, is forecasted to increase at a healthy rate of 3 percent and 7.0 percent in 2015 and 2016, respectively.

- With positive growth in real GDP, exports and construction spending, the California and Orange County economies will show relatively strong growth in job formation. On an annual basis, Orange County is forecasted to generate about 47,000 payroll jobs in 2015, an increase of 1 percent. This is sharply higher than the growth rate of 2.5 percent in 2014. California’s payroll employment is also projected to increase by 2.9 percent in 2015, virtually unchanged from the growth rate of 3.0 percent in 2014. As for 2016, both Orange County and California are forecasted to show continued job growth, albeit at a slower pace, adding 41,000 and 402,000 payroll jobs, respectively.

- With healthy job growth, a pick up in wages and higher projected inflation rates, nominal income growth should pick up Personal income which consists of wages and salaries, dividends, rents, interest, proprietor’s income and transfer payments is forecasted to increase in the 4.8 to 5.1 percent range over the 2015-2016 period.

- A pick up in wage growth, positive wealth effects, lower debt services along with lower gas prices will improve consumers’ purchasing As a result, Orange County’s taxable sales is forecasted to increase by 5.2 percent in 2015 and 5.6 percent in 2016. With the exception of food stores, all other categories of sales will be growing in the 4.5 to 7.0 percent range.

- As for the direction of home prices, there are countervailing forces at w Job growth and tight resale inventory suggest upward pressure on prices but that will be somewhat offset by a larger supply of new homes and lower housing affordability.

- With estimated median family income in Orange County at $89,000 in 2016, a potential buyer needs to allocate 9 percent of that income to pay for property taxes, interest and principal to buy a median-priced home in Orange County. This ratio is computed after taking into account federal and state tax savings resulting from the deduction of mortgage interest and property taxes from taxable income. A 37.9 percent share of income is significantly lower than the 47.1 percent needed in 2006 but is sharply higher than 26.4 percent needed in 2012.

- On balance, our forecast calls for Orange County median home prices to increase by 8 percent in 2015 and 3.7 percent in 2016. A similar trend is expected for California, with median prices increasing by 5.4 percent and 4.4 percent in 2015 and 2016, respectively.

ABOUT THE ANDERSON CENTER FOR ECONOMIC RESEARCH

The A. Gary Anderson Center for Economic Research (ACER) was established in 1979 to provide data, facilities and support in order to encourage the faculty and students at Chapman University to engage in economic and business research of high quality, and to disseminate the results of this research to the community.

Add comment