Thanks to small job gains, a slight thaw in investor spending and relatively solid exports to markets beyond the Eurozone slowdown, Chapman University’s economic forecasters predict continued slow healing of the economy in 2012.

But underscore slow.

“I wish I had an exciting forecast for you like ‘Breakaway rapid growth, healthy recovery!’ But at least it’s a lot better than a double-dip or another recession next year,” President Jim Doti said during Tuesday’s presentation of the annual Chapman Economic Forecast. Developed by the A. Gary Anderson Center for Economic Research, the forecast was presented to about 1,500 Orange County business leaders at a conference held at the Segerstrom Center for the Arts in Costa Mesa.

Orange County and other coastal counties will experience a slightly better pace of recovery because their economies are more diversified than their inland counterparts throughout California, said Esmael Adibi, Ph.D., director of the Anderson Center.

“Inland counties are waiting for construction and retail to come back,” Dr. Adibi said. Furthermore, the Sacramento region has been hit hard by job cuts in the government sector.

California’s leading trade partners continue to be Mexico, Canada and Asia, offering some protection from the European economic downturn, Dr. Adibi said. If the European crisis over the euro or Italy’s economic situation worsens, the United States could face another recession, the forecasters said. But they predicted that it will avoid total collapse.

“We are assuming it will not be a meltdown and that it will survive, and it will survive as the result of all sorts of Band-Aids being put on it,” President Doti said.

Other highlights of the Economic Forecast:

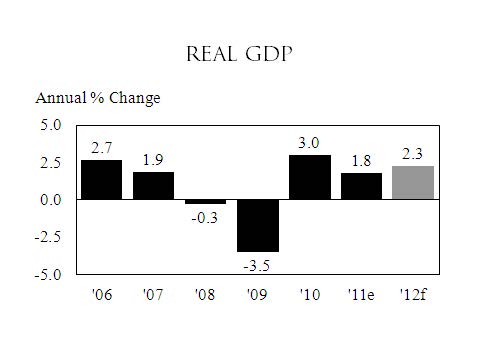

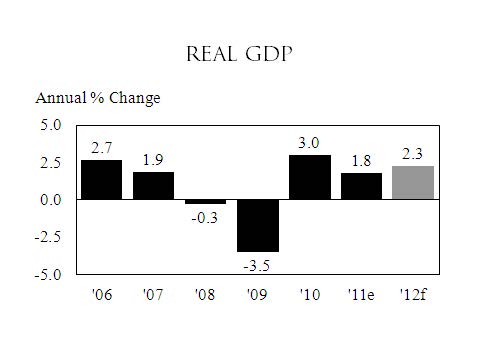

• The Chapman econometric model calls for continued weak but non-recessionary growth in 2012. The annual rate of real GDP growth is forecasted to increase marginally from 1.8 percent in 2011 to 2.3 percent in 2012.

• Part of this growth will come from investment spending. Steady increases in the capacity utilization rate suggest increasing investment spending, which will be fueled by healthy balance sheets and strong liquidity positions. Our forecast calls for real investment spending to increase from a 4.3 percent rate of growth in 2011 to 6.5 percent in 2012. This represents an increase in direct spending of about $116 billion.

• Another sector expected to be an engine of economic growth next year is the all-important consumer spending sector. Relatively strong growth in personal income and household net worth, coupled with a sharp drop in the savings rate, point to high levels of consumer spending. By the end of 2012, we are forecasting quarterly growth rates in consumer spending to exceed 3 percent for the first time since late 2010.

• The housing sector is typically a major of engine of growth in a recovery, particularly in its early stages. But that’s not the case this time around. Housing starts continue to be mired at low rates around 600,000 units annually. With about 1.5 million vacant homes and apartments and the number of homes and delinquent mortgages still well above historic norms, there will be no meaningful impact from the housing sector next year. The abysmally low annualized rate of 602,000 housing starts forecasted for 2012 does, however, represent a 3.2 percent increase from an even lower 583,000 units started in 2011.

• The number of vacant homes and foreclosures is declining, however, albeit at a very slow rate. This suggests that the worst in terms of housing depreciation should be behind us. Housing prices are forecasted to show slightly positive appreciation in the second half of 2012.

• Weakness in the global economy is expected to bring an end to the net export recovery that over the last year has been a positive force for economic growth. We are forecasting that real net exports will decline, on average, about $30 billion from 2011 to 2012. Our model is not projecting that Europe’s debt problems will spread to the United States or that the “Greek Problem” will spread to Italy. That risk is not only real but a significant enough threat that if Italy goes bankrupt, the repercussions are likely to push the U.S. into recession.

• With long-and short-term interest rates near zero and banks awash in excess cash and reserves, little is to be expected from the Fed in terms of any impact on overall economic activity. We believe the fed funds rate will hold steady throughout 2012. We are forecasting increases of just over 100 basis points in the rates of both long-and short-term treasuries.

• The all-items CPI is forecasted to grow at an annual average 3.2 percent rate in 2012, about the same as the 3.1 percent rate of increase currently estimated for 2011. The core personal consumption expenditures price index, however, which excludes food and energy costs, is expected to increase 2.1 percent – sharply higher than the annual increases of around 1.5 percent recorded over the past three years.

2012 California and Orange County Forecasts:

• The most recent available data from the Employment Development Department show that California generated about 193,000 payroll jobs during the first ten months of 2011—a growth rate of 1.3 percent. Only Santa Clara and San Diego are growing faster than the California average. Four counties are still losing payroll jobs. Sacramento, with a disproportionate share of government jobs, is at the bottom of the list.

• With high inventory of unsold homes and high commercial real estate vacancy rates, construction spending nosedived over the 2007-10 period. The good news is that construction spending has dropped to such a low level, it is not likely to get any worse. In fact construction spending is forecasted to increase by 5.6 percent in 2012.

• After a setback in the first quarter of this year, caused mainly by the Japanese earthquake and tsunami, California’s merchandise exports increased to $40.5 billion in the third quarter of the year. This is an increase of $7.5 billion since the first quarter of 2010. The outlook continues to remain positive. California’s largest trading partners, particularly Mexico, Canada and China are experiencing solid growth. Japan, our fourth largest trading partner, launched a massive rebuilding effort that bodes well for our exports. And although the Eurozone economy may experience contraction, only Germany and Netherlands are among California’s top ten export destinations.

• With improvements in construction spending and projected increases in exports and real GDP, weak but positive job growth will continue in 2012. In annual terms, the forecast calls for a gain of 21,000 payroll jobs in Orange County and 237,000 payroll jobs in California—a growth rate of 1.6 percent and 1.7 percent, respectively. The recovery will be broad-based, with both services and goods-producing sectors gaining payroll jobs in 2012.

• Based on current estimated median family income, a potential homebuyer needs to allocate 28.2 percent of his monthly family income to purchase a median-priced home in Orange County, significantly lower than 46.6 percent needed in 2006. This figure is based on the assumption that a homebuyer uses a 30-year fixed rate mortgage with 20 percent down payment.

• In spite of marked improvements in housing affordability, lending standards are so rigid that many potential buyers have difficulty in securing financing necessary to purchase a home. This has resulted into an anemic sales activity.

• More problematic is the inventory of unsold homes. Not only are there still too many unsold housing units in the market, there are a large number of homes in the foreclosure process that will keep the supply of resale housing units at an elevated level.

• On balance, our forecast calls for the median selling price of a single-family unit, as reported by the California Association of Realtors, to decrease by 2.5 percent in California and remain flat in Orange County in 2012.

• The long-run correlation between new jobs and new completed housing units points to a large disequilibrium between potential demand and supply. The ratio of new civilian jobs to completed housing units over the 2000-2010 period was well below 1.0 for California and its 10 largest metropolitan areas. This ratio was 1.6 in California and 1.2 in Orange County over the 1990-2000 period. The only way this ratio can improve is for the economy to generate stronger job growth to convert potential demand into actual demand and lead to a broad-based and sustainable home price appreciation.

• Contractions in jobs and income led to a collapse of consumer spending over the 2008-2009 period. Sharp spending declines, particularly on durable goods such as home furniture, appliances, building material and automobiles, were a major drag on overall spending growth and the economy. Helped by the surge in automobile purchases, both used and new, 2011 showed a marked improvement in total taxable sales. For 2012, our forecast calls for taxable sales to increase by 5.7 percent in Orange County and by 5.4 percent in California.

Add comment