The coronavirus pandemic has been unlike anything the U.S. has seen before, but the period just around the bend will swoosh in with a bit of déjà vu, say Chapman University economists.

Think post World War II and the end of constrained wartime consumer spending. Thanks to a similar cause-and-effect pattern, the post-COVID U.S. economy will expand by a vigorous 5.7% in 2021, Chapman economic forecasters say.

Pent-Up Consumer Spending Is ‘Dry Powder’

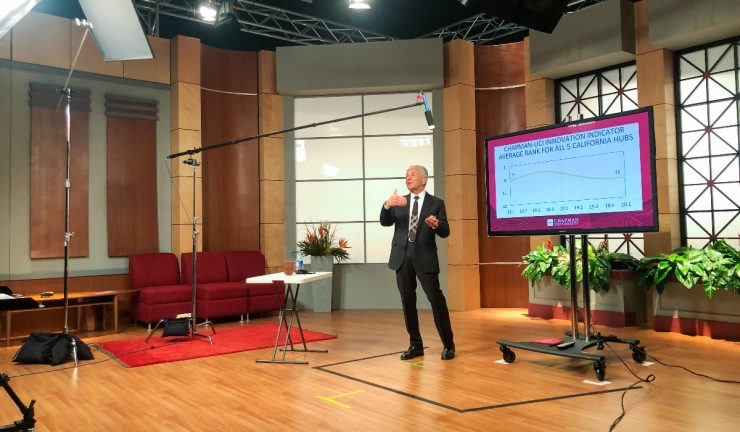

What many consumers are keeping tight in their piggy banks right now, along with gains in home values, stock portfolios and relief from an expected second CARES Act, is akin to “dry powder,” awaiting the spark of better days, said economist and President Emeritus Jim Doti during Chapman’s annual Economic Forecast Report, delivered virtually this year.

“That pent-up demand is building, (and) that will fuel a sharp turnaround in real GDP growth,” said Doti, Ph.D., who leads the research presented every December by the A. Gary Anderson Center in Chapman’s Argyros School of Business and Economics.

Orange County, though, has work to do if it wants to fully capitalize on boom times. In this year’s report, Doti introduced the Chapman-UCI Innovation Indicator, a gauge that measures growth in the innovation industries, which bring high-paying professional jobs to the regions where they locate.

Based on the Chapman-UCI Innovation Indicator, Orange County ranked 14 out of 22 U.S. innovation hubs. The tepid showing on the innovation chart gelled before COVID-19, he added.

“While California was growing at 1.3% to 1.4%, Orange County was just about zero growth,” he said. “That warrants more economic scrutiny.”

Innovation Indicator Backed by Research

Scholars from the two universities partnered with the CEO Alliance of Orange County to develop the new metric that takes a quarterly snapshot of how Orange County compares with other tech hubs across the nation. Going forward, the new indicator will help the county focus on building the region into a nationally competitive innovation powerhouse, which Doti said “can lift all boats in our county.”

Lives Saved by COVID-19 Restrictions

Compared with many other states, California’s economy took a harder hit from COVID-19 because its tourism and entertainment industries were especially vulnerable to stay-at-home restrictions, the forecasters said.

Simultaneously, they said, California’s tougher restrictions saved 6,600 lives, but cost 500,000 jobs. The COVID-19 benefit-cost research has already been published in Social Science Research Network. The center’s researchers plan to make similar analyses of coronavirus restrictions in other states as well.

No. 1 in Economic Forecasting

The Chapman report continued its role as a leader in economic forecasting, shaped by the highly accurate econometric model developed by Doti and fellow Chapman researchers. Anderson Center’s annual Economic Forecasts are recognized as one of the oldest and most respected in the nation.

The June Forecast Update scored similar accuracy success. It was one of the most optimistic in June, calling for a V-shaped recovery from the COVID-19 recession. That prediction was validated by the sharp increase in third-quarter real GDP, Doti said.

Missed the Forecast or Want to Learn More?

- The Economic Forecast presentation is available for complimentary viewing online.

- The complete Economic & Business Review is the deep dive report that includes comprehensive national, state and regional data valued by decision-makers, analysts, researchers and students. Reserve your copy today.