The A. Gary Anderson Center for Economic Research at Chapman University on Wednesday, Dec. 9, released the results of its 38th annual economic forecast for the U.S., California and Orange County. The forecast was presented to about 1,500 Orange County business leaders at the conference held at the Segerstrom Center for the Arts in Costa Mesa. Following are highlights from the center’s forecasts.

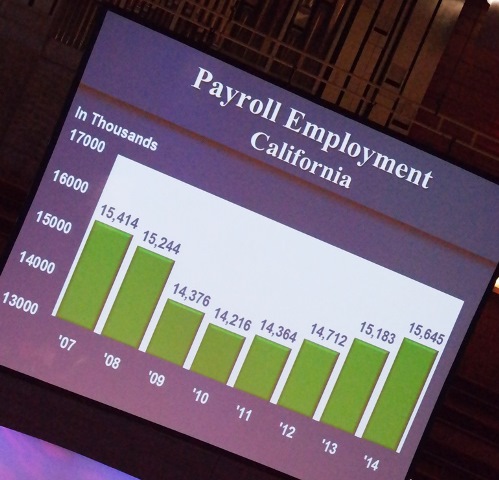

Professor Esmael Adibi, Ph.D., director of the Anderson Center, reviews California’s employment growth at the Economic Forecast.

2016 U.S. Forecast

- While the short-run impact of the sharp drop in crude oil prices was negative in 2015, our econometric model clearly points to positive effects emerging in 2016. Specifically, the model suggests that every one dollar decrease in the price of crude oil will increase real GDP by 0.03 percent three quarters later.

- Consumer spending, which accounts for about 70 percent of GDP, will be the major engine of growth in 2016. We see low gasoline prices, low debt levels and continued gains in household wealth keeping consumer spending growth near three percent.

- A moderate pickup in export growth is expected in 2016 as the European and Asian markets improve. But because of the sharp increase in the value of the U.S. dollar, exports will definitely not be the growth machine it was during the early stages of the current recovery.

- The downward drift in the ISM Manufacturing Purchasing Managers Index to a recent level of 50 points to weak growth. But stronger growth in IT will lead to a pickup in investment spending to almost five percent.

- The fact that inventories of unsold homes are at historically low levels also augurs well for a strong housing market. Housing starts are forecasted to continue increasing but at a lower rate of growth. This suggests that housing will continue to be an engine of growth, but our projection calls for a slight deceleration.

- For the first time since the strong fiscal stimulus during the early stages of the current recovery, government spending is expected to be a positive force. Government purchases are forecasted to increase about $63 billion in 2016, adding about 0.4 percent growth in real GDP.

- Overall, we are forecasting real GDP to grow at a 2.8 percent rate in 2016. Real GDP growth of 2.8 percent is expected to generate enough job growth and pressure on wages to push inflation above two percent by mid-2016.

- We believe the pickup in real GDP growth, coupled with some buildup in inflationary pressure, should lead the Fed to increase the Fed funds rate by about 100 basis points through 2016. This will lead to a similar increase in the 90-day Treasury bill rate.

2016 California and Orange County Forecasts:

- The most recent statistics released by the Employment Development Department (EDD) show payroll employment in California at 16,199,000, about 745,000 above the peak achieved prior to the recession. In Orange County, payroll employment is only 20,000 above the employment peak before the beginning of the recession.

- In California, payroll employment in the manufacturing, construction, financial activities, and government sectors are still well below their previous peak. The education & health services, professional & business services, and leisure & hospitality sectors have made nice comebacks.

- In Orange County the picture is slightly different. Employment in five major sectors of the economy in the third quarter of 2015 is well below its pre-recession level reached in the third quarter of 2007. Education & health services and leisure & hospitality sectors gained most of the jobs followed by a small gain of jobs in professional & business services.

- Continued spending growth emanating from construction spending and consumer spending will more than offset sluggish export growth, leading to higher levels of employment in California and Orange County. Overall, in annual terms, our forecast calls for a gain of 460,000 payroll jobs in California and 48,000 payroll jobs in Orange County in 2015, a growth rate of 2.9 percent and 3.2 percent, respectively. In 2016, our forecast calls for job growth of 2.4 percent in California and 2.5 percent in Orange County.

- Recent data released in September of 2015 show that San Francisco and Santa Clara’s median home prices surpassed their pre-recession peaks. All other areas showed median prices well below their pre-recession peak levels.

- A better job market and a lower unemployment rate should induce household formation and home-buying activity. But in spite of low mortgage rates, housing affordability has declined sharply since 2012, when home prices rebounded and income growth was stagnated.

- On balance, Orange County’s median single-family home prices, as measured by the California Association of Realtors, are forecasted to increase by 2.8 percent in 2015 and 2.5 percent in 2016. A similar trend is projected for California’s median single-family home prices. For 2015, our model calls for a home price appreciation of 4.8 percent followed by a 3.7 percent increase in 2016.

ABOUT THE ANDERSON CENTER FOR ECONOMIC RESEARCH

The A. Gary Anderson Center for Economic Research (ACER) was established in 1979 to provide data, facilities and support in order to encourage the faculty and students at Chapman University to engage in economic and business research of high quality, and to disseminate the results of this research to the community.

Add comment