Since the spread of COVID-19, many have become familiar with the 1918 flu pandemic. The virus killed 2% of the world’s population and produced high rates of mortality in healthy people, including those 20 to 40 years old, as reported by the U.S. Centers for Disease Control and Prevention.

Now, a Chapman University professor has distilled the impact of the 1918-1920 pandemic on U.S. stock returns, finding that the rate of growth of pandemic-related deaths “may be an important factor in predicting stock returns and future economic conditions during a health crisis.”

Marc Weidenmier, a professor in Chapman’s Argyros School of Business and Economics, painstakingly collected data from each week of the flu’s spread and published a working paper through the National Bureau of Economic Research (NBER), where he is a research associate. He wanted to show the economic impact of a pandemic and chose the 1918 flu because it was “the closest thing” to COVID-19 but didn’t have the same outside influences, like government stimulus packages.

Weidenmier says that while researchers have published papers about the 1918 flu pandemic, “no one has pushed the angle of pandemic variables and prediction of stock equity markets and future economic conditions and recessions.”

Other papers on the subject have used monthly rather than weekly data, which can mask reality. Using weekly rather than monthly data “gives you a lot more statistical power, and also gives you more insight into what’s really going on,” he says.

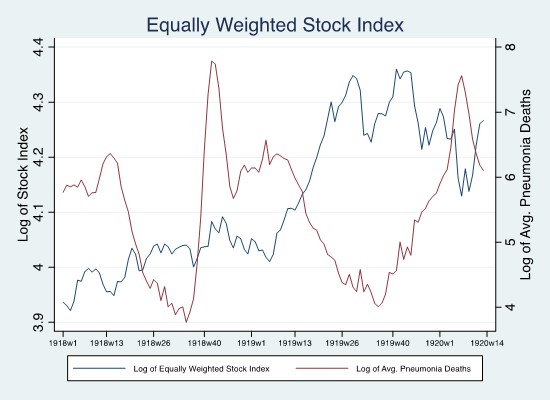

Spikes in 1918 Flu Curb Stock Returns

The paper shows that the most deadly spikes in the pandemic significantly reduced the stock market returns of the more than 130 firms tracked by Weidenmier and his research colleagues. The second spike of the pandemic lowered returns by 57 percent, and returns during the fourth spike were down 33 percent – a significant impact, according to the paper.

People may be tempted to use Weidenmier’s research to project the COVID pandemic’s economic impact in the United States, but there are key differences – and the 1918 flu gives a better picture of impact, he says.

“There’s very little government intervention at that time, so it gives you kind of a clear take of the effect,” says Weidenmier.

By contrast, “it’s hard to say what the impact of COVID was because there was a government-imposed lockdown. You had stimulus packages left and right, trillions of dollars. You had the Fed trying to cut interest rates to zero,” he says.

In addition, there was also no vaccine for the 1918 flu.

That virus “hit the working-age population particularly hard, as opposed to COVID-19,” which had the biggest impact on people older than 65, according to Weidenmier and his co-authors.

“That was one of the motivations for the paper – we’re going to look at a pandemic that affects the working-age population,” Weidenmier says. “It’s a short-term effect, but the effect is quite large.”

Additionally, it turned out that death rates were even better at predicting recessions than the stock market was, Weidenmier says. There were two recessions during the 1918-1920 pandemic period. Death rates may be particularly effective at predicting recessions in emerging markets in places like South America and Southeast Asia, he says.

He and his co-authors gathered and digitized weekly stock data for 136 firms, using The New York Times’ financial section from January 1918 to March 1920. They also used U.S. Census pneumonia mortality data from about 60 regions.

Bringing Fed Policy Leaders to Chapman

When Mary Daly, CEO of the Federal Reserve Bank of San Francisco, spoke at Chapman University last summer it was because of Professor Marc Weidenmier.

Since 2018, Weidenmier has organized and moderated the Shadow Open Market Committee Conference at Chapman. The conference brings monetary economists from academia and private organizations together to discuss Fed policies.

Since the first conference, “we’ve had some really heavy hitters out here,” Weidenmier says.

Those include MIT’s Deborah Lucas, former chief economist at the U.S. Congressional Budget Office; and Charles Plosser, former president of the Federal Reserve Bank of Philadelphia.

The June 2022 conference at which Daly gave the keynote speech drew coverage from national media outlets like The Wall Street Journal, Bloomberg and Fox Business.