Remember aerospace jobs? They’re back, according to Chapman University’s 2018 Economic Forecast. Particularly in Orange County.

“If you just look at individual categories, the highest manufacturing sector since 2010? Aerospace. This is a surprise,” said economist and Chapman President Emeritus Jim Doti, who presented the 40th annual report.

Medical supplies and equipment products share that trend, too, Doti said. While other manufacturing leaves the area, growth in such better-paying industries signal a changing local economy, Doti said.

“There’s this transformation going on in the county, at least from 2010. While overall we may be losing manufacturing jobs, we’re gaining high value-added (jobs),” Doti said. “We’re doing pretty well.”

That insight was among several highlights presented at the forecast conference, which began as a classroom project decades ago and now is the signature event of Chapman’s A. Gary Anderson Center for Economic Research.

Nationally, the U.S. economic recovery will continue at a slow-but-steady pace, Doti said.

“It’s a long recovery. It’s now the second longest recovery on record in the United States, but also one of the weakest,” he said. “We don’t see, at least next year, the kind of growth in the 3 to 4 percent range that the administration is talking about. But that might be in the offing in the future.”

Of greater concern for Californians are moves to end the North American Free Trade Agreement (NAFTA), which he described as a job creator for California. Doti counted it as an even bigger threat to California’s economy than proposed changes to real estate property tax laws.

Killing NAFTA would result in “a loss of almost 300,000 jobs in California per year. Not insignificant and something to worry about,” he said. “Whether that happens or not, we’ll have to keep close tabs on. But this is the most serious negative.”

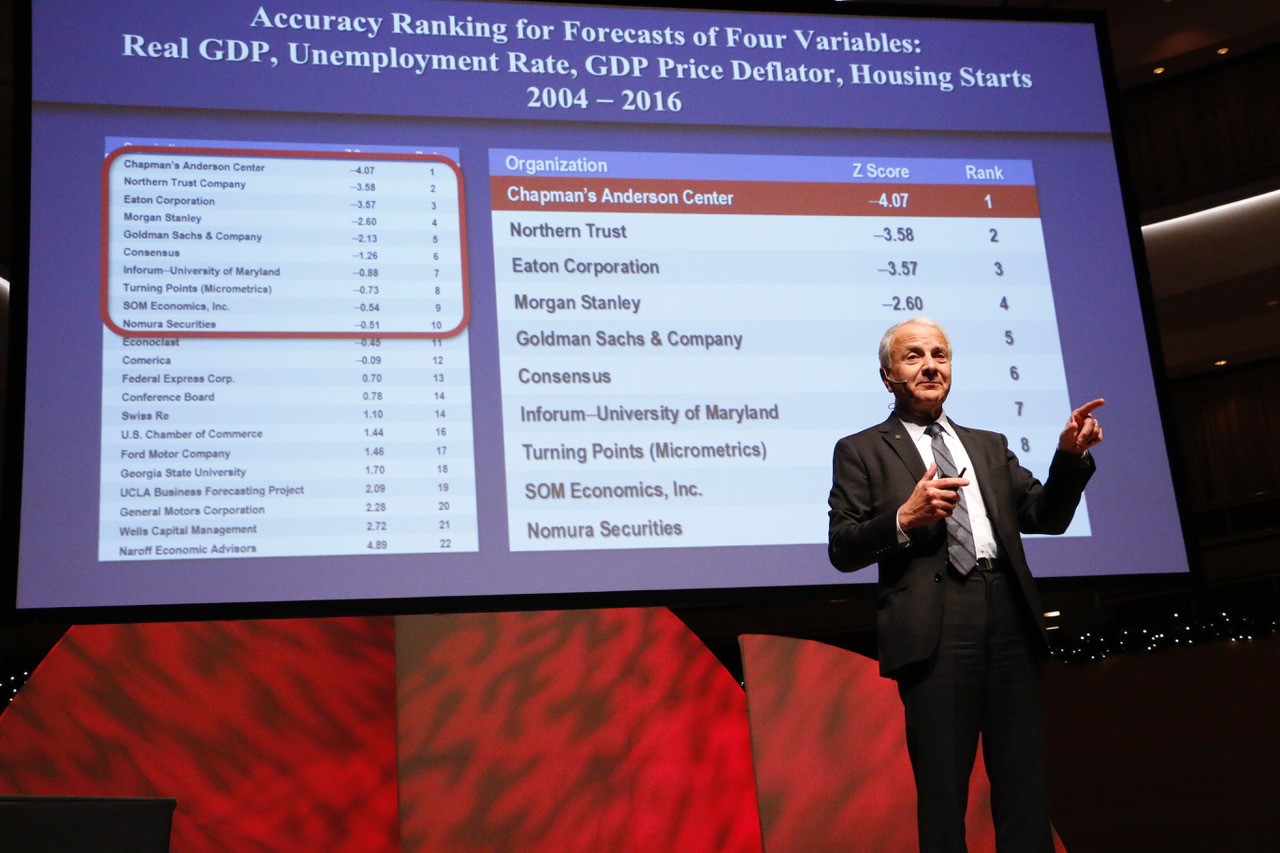

Display image at top/President Emeritus Doti shares a slide showing the track record of accuracy for the Anderson Center forecasts.

Following are excerpts from the Anderson Center’s forecast 2018 Economic Forecast press release. Watch for the full summary soon at the center’s website.

2018 U.S. Forecast

Overview:

Although cumulative growth during the current expansion has been weak when compared to other recoveries, it is now the second longest expansion on record. The critical question now is whether the expansion can endure in the face of full employment and falling productivity. Historically, three economic trends have consistently signaled the end of expansions and onset of recession. Those signals include a negative interest rate spread (short-term interest rates are higher than long-term rates), a sharp drop in housing starts and rising levels of private debt. With none of these recessionary signals in sight, we are confident that the expansion will continue through 2018. The rate of real GDP growth, however, is forecasted to decline slightly from 2.3% currently estimated for 2017 to 2.2% in 2018.

2018 California Forecast

Overview:

After experiencing sharper job losses and higher unemployment than the U.S. during the Great Recession, California caught up by the end of 2013 and has since outpaced the nation in job growth. But these macro trends mask a number of structural changes in the California economy. In comparison to the U.S., California’s manufacturing sector has hardly grown. The state’s weakness in this sector, however, has been more than offset by very strong relative growth in construction and information services jobs. These sharp swings in the pattern of job creation point to California’s

shedding of lower value-added manufacturing jobs to higher value-added jobs in information services. The swings also suggest that California is becoming increasingly dependent on the cyclical and volatile construction sector. The most important variable, real GDP, is forecasted to show little change, while declines in the other variables are mild. As a result, we are forecasting a slight decline in California employment growth from 1.7%

in 2017 to 1.5% in 2018.

2018 Orange County Forecast

Overview:

After recovering from a deeper trough during the Great Recession, Orange County mirrored California’s job growth trajectory. In 2015, Orange County’s job growth topped both California and the U.S. The county fell below California in 2016 but still outpaced the U.S. by a considerable margin.

Add comment