The A. Gary Anderson Center for Economic Research at Chapman University released today the results of its 33

rd

annual economic forecast for the U.S., California and Orange County. The forecast was presented to about 1,500 Orange County business leaders at a conference held at the Orange County Performing Arts Center, Costa Mesa.

President Jim Doti and Esmael Adibi, Ph.D., director of the A. Gary Anderson Center, predicted a tepid recovery from the recession.

“Most of it relates to the weakness in the construction industry,” President Doti said.

President Doti and Dr. Adibi discuss the forecast in an exclusive video interview at

OC Metro

.

Additional coverage of the event can be found in Jonathan Lansner’s

“On Real Estate”

column and Mary Ann Milbourn’s ”

Handling Hard Times”

column in the Orange County Register.

Highlights of the forecast:

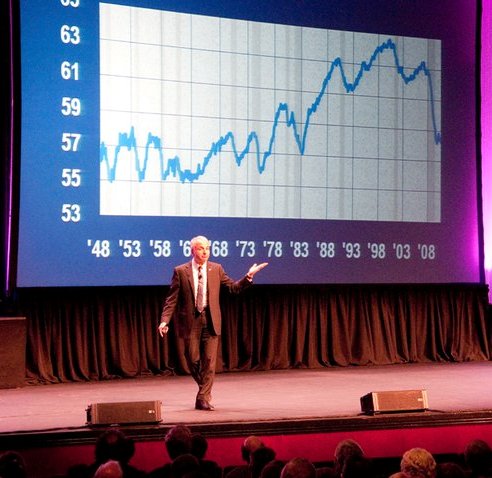

- The recovery will continue at a relatively slow pace in 2011, with real GDP increasing by a modest 3.3 percent. While this would be the strongest growth since 2004, when real GDP increased 3.6 percent, it still pales in comparison to the rebounds that historically have followed deep recessions.

- The continuing mild recovery will be enough to generate 1.7 million net new jobs in 2011, which will cause the unemployment rate to drop about one percent, to 8.6 percent, by year-end 2011.

- The construction industry is still mired in recession. Construction employment has dropped almost 10 percent during the first six quarters of the recovery. Housing starts remain virtually flat at around 600,000, reducing real GDP by 2.6 percent compared to what it would have been if housing had come back as it did in previous recoveries following deep recessions.

- Despite high housing affordability and low mortgage rates, there will be no sharp rebound in housing next year. Our forecast calls for housing starts to increase 7.2 percent, from 600,000 to 640,000 units. Homebuyers’ concerns about unemployment and the ongoing problems in the mortgage industry, couples with a large excess supply of vacant units on the market, will constrain production of new homes.

- Projections call for a 4.6 percent increase in total investment spending in 2011. Because of high vacancy rates, nonresidential construction will be in even worse shape than the residential sector. Investment spending will be fueled by inventory rebuilding and spending on plant and equipment.

- There will be no net increase in fiscal stimulus to quicken the pace of recovery. There is still about $200 billion left of the $780 billion stimulus package to be spent in 2011, but that will be about the same fiscal stimulus spent this year. Moreover, the changing of the guard in the House of Representatives is likely to stifle any new major thrusts in government spending.

- We are forecasting positive, but very slight, net exports growth of 1.8 percent in 2011. Fears of long-run inflationary pressure, fueled by the Fed’s actions in purchasing treasuries and mortgage-backed securities, are likely to lead to further declines in the value of the U.S. dollar. While this will serve to make U.S. exported goods and services more competitive, it will also increase manufacturing costs. Consumer spending should increase a solid 3.2 percent next year. We predict the new Congress will preserve the Bush tax cuts, at least for the next few years, and rising home prices and recovering stock markets will improve consumers’ balance sheets.

- After four consecutive years of decline, resale housing prices turned the corner in 2010, growing at a barely positive rate of 0.6 percent. Our forecast calls for continuing improvement in 2011, with housing prices increasing 3.3 percent. Like new housing starts, home prices will be constrained by consumer anxiety as well as the significant overhang of vacant housing units on the market.

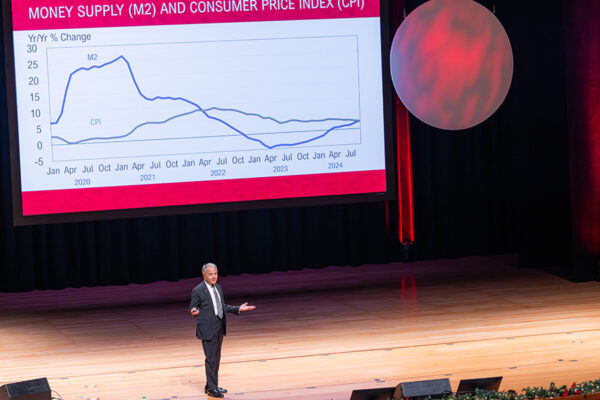

- The inflation rate is expected to remain basically unchanged, with the all-items consumer price index increasing from a 1.6 percent growth rate in 2010 to 1.8 percent in 2011.

- The relatively weak recovery, along with the Fed’s expansionary monetary policy, will keep short-term interest rates, like the Fed funds rate and the 90-day treasury bill rate, near zero. Increased concerns about long-run effects of the Fed’s actions will push long-term interest rates up about 100 basis points. We are forecasting an increase in the 10-year treasury bond rate from 2.7 percent currently to around 3.9 percent by the end of next year.

2011 California and Orange County Forecasts:

- At the state and local levels, movements in payroll employment are generally used to gauge beginning and ending of recessions. California payroll employment peaked in July 2007 at 15.2 million jobs and showed rapid declines through 2008 and 2009. By December 2009, payroll employment hit a trough at 13.8 million jobs. Based on this measure, the recession at the state level lasted 29 months with 1.4 million job losses, or a decline of 9.2 percent.

- The recovery in the job market began early this year. Since January of 2010, California gained 47,900 (0.3 percent) payroll jobs compared to the U.S. job gains of 874,000 (0.7 percent). The relatively poor performance of California’s economy compared to the U.S. in this business cycle is mainly due to weakness in three industries: construction, financial activities and professional & business services sectors.

- Many employees in the construction, financial, professional & business services sectors earn wages and salaries that are much higher than the average income in the state. As a result, sharp employment declines in these sectors negatively impacted income and spending growth and reduced California tax revenue, exacerbated the structural budget deficit.

- Positive trends in real GDP and real exports more than offset the forecasted weakness in construction spending leading to a pickup in job growth in 2011. On average, total Orange County payroll employment is forecasted to increase by about 23,000 jobs, an increase of 1.7 percent. California employment is forecasted to increase by 1.2 percent—167,000 net new payroll jobs.

- The service-producing sector will be the main engine of job growth. The professional & business (2.8 percent), education & health (2.7 percent) and leisure & hospitality (2.5 percent) sectors are projected to show the highest rate of job creation in Orange County. The pickup in jobs, although weak, will increase personal income and taxable sales spending in California and Orange County. Total taxable sales is projected to increase 4.7 percent in Orange County verses a growth rate of 4.4 percent in California.

- The positive trend in personal income and taxable sales growth should improve the state’s general funds revenue, but the structural deficit will remain intact. Our estimate shows that the state is facing a $22.0 billion deficit in fiscal year 2011-2012.

- The job recovery should positively affect housing demand. And the expected rebound in income, low mortgage rates and lower home prices are helping to keep housing affordability at historical highs, leading to increased housing demand particularly for first-time homebuyers.

- A pickup in new residential construction, high inventory of resale homes and existing shadow inventory (estimated at about 5,000 units in Orange County) will mostly offset the positive factors influencing demand.

- Our forecast calls for the median resale single-family home prices to increase 3.0 to 4.0 percent in California and Orange County, mainly due to changes in the mix of homes sold. Although we project the median price of homes sold to increase moderately, high inventories of relatively expensive homes (above the median price) suggests that further downward price pressures in this segment of the market is likely.

[…] now that the world’s various stimulus packages have all but evaporated without any job recovery to show for, who will foot the multi-billion dollar bill of all this upper class […]

[…] now that the world’s various stimulus packages have all but evaporated without any job recovery to show for, who will foot the multi-billion dollar bill of all this upper class […]